What if you could avoid getting duped–and instead focus on financial strategies that can give you liquidity, safety, predictable rates of return, and tax-free income? That would be the best lifetime investment, wouldn’t it? Let me show you what I’m talking about…

Let’s start with the test that any prudent investment must pass–the LASER Test. Ideally, you want the financial vehicle to perform well in all four areas:

- Liquidity – The ability to access your cash whenever you need it (ideally with little to no penalties, taxes or fees)

- Safety – The ability to protect your principal from loss, as well as safety of the institution in which your money is entrusted

- Rate of return – The goal here is to earn a competitive rate of return that historically has beaten inflation, and if you can have that rate of return under tax-favorable circumstances, it will dramatically increase not only the end result, but also the net spendable income available during your “harvest” years

- Tax advantages – Ideally you want to have tax advantages when your money is growing, when you access your money, and when you transfer your money to your heirs upon your passing

DOES YOUR FINANCIAL VEHICLE PASS THE LASER TEST?

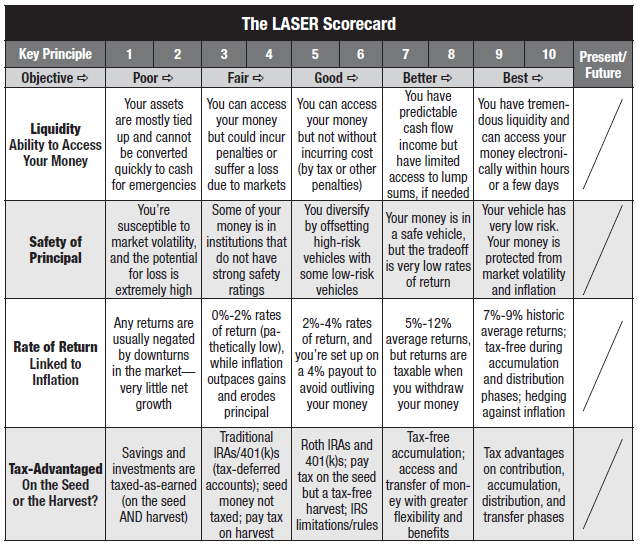

I’ll share, in my opinion, how popular financial vehicles fare with the LASER Test. In fact, in many of my books I provide a LASER Scorecard to help readers analyze their options on a scale of 1 to 10.

Unfortunately, Americans put their money into a lot of traditional vehicles that score only around 18 to 22 points. Market-based vehicles, for example (mutual funds, IRAs, 401(k)s, etc.) expose their money to market volatility, thus ranking lower on safety. IRAs and 401(k)s may be liquid, but the 10% penalty for early withdrawal takes the liquidity points down a few notches. Similarly, IRAs and 401(k)s may be tax-advantaged on the front end, but on the back-end? When you’re hit with taxes on withdrawals, the tax advantaged score takes a hit.

THE HIGH SCORE GOES TO…

I don’t know of any investment that ranks a perfect score of 40, but my favorite vehicle scores between 33 and 35. I know of no other investment vehicle that allows you to pass liquidity, safety, rate of return, and tax benefit tests with flying colors like a properly structured, maximum-funded Indexed Universal Life policy, or what I affectionately call The LASER Fund.

When it comes to liquidity, The LASER Fund allows you to access your money at any time, at any point– even while you’re still funding the policy in the first four to seven years. Of course you want to access your money the Smart Way by borrowing it via loans (see my article, “What Is the Smartest Way to Access Cash out of an IUL?” for more), but you can do so any time–and it’s income-tax-free.

How about safety? Insurance companies are among the safest institutions for your money, as evidenced during The Great Depression and Great Recession, when they survived and banks and credit unions failed. Furthermore, with a LASER Fund, your account value is protected by a 0% guaranteed floor, meaning when the market drops, you won’t lose a dime to market volatility. And when the market gains, you can earn right alongside the market, because your money is LINKED TO the market, not IN the market.

As for predictable rates of return, currently, a retirement nest egg of $1 million can predictably (based on historical averages) generate an annual income stream averaging 5% to 10%, income-tax-free. Of course, there may be down years, but here again the 0% guaranteed floor means your account values are protected from market loss. And while these may not be not pie-in-the-sky, get-rich-quick rates of return, predictability can be invaluable.

Finally, The LASER Fund’s tax advantages are among my favorite because you’re putting in after-tax money; your money is growing tax-free; and when you access your money, it’s yours income-tax-free. Even more, when you pass away, your money transfers as an income-tax-free death benefit to your beneficiaries.

This is why I would rather have a generator than a battery. A generator generates power, hopefully into perpetuity. It doesn’t get shorted out. Batteries, on the other hand, are susceptible to dangers like taxes and market volatility.

A SUCCESS STORY

Throughout my career, I’ve seen countless people convert their money to the best strategy for accumulating money and transferring their money income-tax-free. Let me share one story with you.

This couple was very successful, and they had accumulated a sizable amount of money in tax-deferred IRAs and 401(k)s. But they realized they were in a tax trap–they would be hit with significant taxes once they started withdrawals for retirement. Over about five years, they performed a strategic rollout (not a rollover), moving their money into LASER Funds. We helped them establish four policies.

They were interested in getting superior liquidity, safety, predictable rates of return, and they wanted to convert at least 60% of their income during retirement to tax-free income that wouldn’t show up on their tax return.

I love this story because they started out in the highest tax bracket–which they would have remained in the rest of their lives–and in five short years they moved to essentially a 0% tax bracket. Now they enjoy about $800,000 a year of tax-free income, and they say it was worth going through the conversion process. (This story is used as a real-life example, not a guarantee of performance for other clients. Each situation is unique–so be sure to consult with an experienced IUL specialist to explore your LASER Fund options.)

So the key takeaways here are the importance of choosing financial vehicles that score well on the LASER Test, and that can help minimize the dangers of taxes and market volatility. Of course, you also want a strategy that can generate the most net spendable income at the time in life you’re going to need the money the most (vs. a battery strategy that could run out before you do).

WANT TO LEARN MORE?

Watch the Video – Watch the related YouTube video to see me explain “What Is the Best Lifetime Investment?” (and while you’re there, be sure to subscribe to my YouTube channel so you don’t miss a thing!).

Elevate Your Financial Dimension – Find out how you can improve your Financial Dimension journey and seize the liquidity, safety, predictable rates of return, and tax advantages of a LASER Fund. Explore the in-depth financial strategies and learn from real-life client experiences by claiming your free copy of “The LASER Fund” book at LASERFund.com. Just pay for shipping and handling, and we will send it to you, absolutely free.

Join a Webinar – Want to find out if a LASER Fund (a maximum-funded, properly structured indexed universal life insurance policy) is right for you? Join us for an upcoming webinar where you can explore these strategies.