Why Uncle Sam Should Already Be on Your Mind

With the holidays still ahead, you might think it’s a little soon to be talking about taxes.

But if you’re among those with traditional IRAs and 401(k)s who are over age 73, you’ll need to take out your annual Required Minimum Distributions (RMDs) by December 31.

And since you’ll be taxed on those withdrawals, this could put you into a higher tax bracket for the year, which means you could owe more in taxes in April.

Even if you’re in your 30s, 40s, 50s, or 60s, it’s never too early to start thinking about Uncle Sam’s take on the money you set aside for the future.

Reactive vs. Proactive?

All too often Americans are reactive when it comes to tax planning. The problem is, when you’re focused only on current taxes, you’re not preventing issues that could turn into bigger burdens down the road.

Because while paying our fair share of taxes for the benefits we all enjoy as Americans is important, we can put ourselves at risk of outliving our money — or simply not enjoying our golden years like we could — when we set ourselves up to pay unnecessary taxes.

To avoid a limited future, start by asking yourself: What is the “why” behind my retirement accounts?

We often just follow the herd, using traditional accounts to set money aside for that “someday,” but we’re not emotionally or mentally invested in much beyond that.

If you go deeper, you might find that your “why” includes having robust resources, where you can not only cover your housing, health care, and basic needs — but you can afford to have meaningful experiences with your spouse and loved ones, like Family Retreats With a Purpose.

You might also want to leave enough behind for your children, grandchildren, and even further generations to fuel their lives with financial abundance.

Keep Your Eye on the Ball

So just like in sports where we teach our kids to “keep their eye on the ball,” the ball in this case is the distribution phase. If you recall, there are four phases of retirement planning:

- Contribution Phase – This is where you’re setting aside money with pre-tax or after-tax dollars (we’re fans of primarily after-tax strategies).

- Accumulation Phase – This is where your money can grow in your financial vehicles (the more tax-advantaged, the better).

- Distribution Phase – This is where you can access your money (and the time of life when it’s most important to protect yourself from unnecessary taxes).

- Transfer Phase – This is where you pass along your money to future generations (and hopefully protect their inheritance from unnecessary taxes).

Which Future Do You Want?

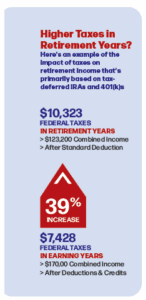

To illustrate the impact of relying solely on traditional accounts for your retirement, here’s a look at a typical tax-year scenario. We have clients, for example, who have $170,000 in combined gross income.

Their itemized deductions include $35,000 in mortgage interest. They get $6,600 in child tax credits for their three children. And they’re socking away $25,000 per year in tax-deferred IRAs and 401(k)s.

After their deductions, they have a taxable income of $110,000, and with their child tax credits they’ll pay about $7,428 in federal taxes.

If we fast-forward to their retirement years, their annual income will drop to about $122,200 a year from their retirement accounts, Social Security, etc. Their mortgage will be paid off and their kids will be grown, so those deductions and credits will be gone.

The standard deduction (including the additional senior standard deduction, based on current IRS numbers) would leave them with about $90,000 in taxable income, which means they’ll be paying over $10,323 in taxes — a 39% increase over their younger years.

This is where we’d invite them to do what thousands of our clients have done and begin conducting a strategic rollout now, moving money from IRAs and 401(k)s into vehicles like properly structured, maximum-funded Indexed Universal Life policies (what we call IUL LASER Funds), so they can enjoy access to tax-free income during retirement.

They could be like our clients Shari and Jeff who got their taxes over with by transitioning nearly all of the money from their traditional accounts into six IUL LASER Funds, ultimately saving over $250,000 in unnecessary taxes.

Now Shari and Jeff have more than $1.5 million they can tap for tax-free retirement income that can last as long as they do, along with a death benefit that can transfer to their children income-tax-free when they pass on.

It’s Your Life, Make It Work for You

The secret is to take control back from Uncle Sam and take charge of your financial future. This is why we encourage you to stay in a tax-season state of mind, no matter what time of year (or period of life) it is.

Because the choices you make today can impact your taxes not only next April, but three Aprils from now, 10 Aprils from now, 20 Aprils from now, and so on.

> Protect yourself from unnecessary taxes — watch Emron Andrew explain these tax-saving strategies in more detail by clicking here.